Will Writing service

A Will is a legal document that allows you to state what should happen to your assets (your money, property, investments, and possessions) as well as your young children after you have died.

Will Writing Service:

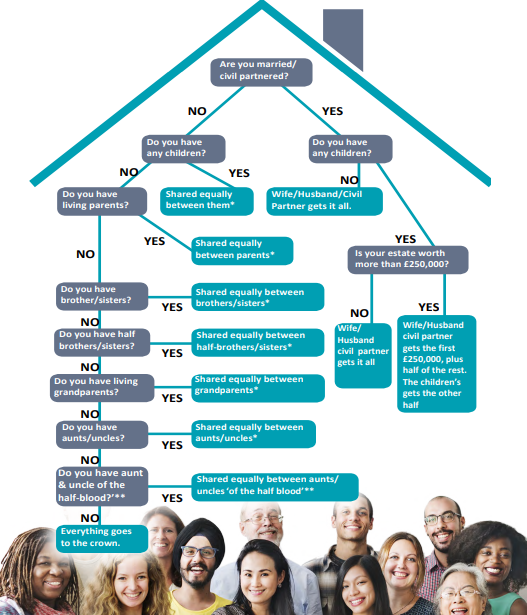

- In the absence of a Will, the government defined ‘Rules of intestacy’ decide how your estate is to be distributed and the court decides who looks after any minor children.

- We are an established Estate Planning and Will Writing Practice firm. Our specialists take the greatest care of your wishes.

- We always think that we have all the time in the world, but sometimes we do not, and we leave our dependents insecure.

Estate planning allows you to put down in words what you want to happen after your death. It will really help the people you leave behind to know exactly what you wanted and make it easier on them. Making sure that you have made plans for after you are gone can give you peace of mind. It is not nice to think about, but it means that your loved ones can carry out your wishes and be protected from inheritance tax.

Where will Your Property go if you do not make a will ?

If you live in England or Wales and die without a legally valid Will the government will decide who gets what. If you have no living family members, all your property and possessions will go to the Crown. If you have children under 18 years old, other people can make decisions about who will take care of the children and manage their finances, education and living arrangements. By making a Will you can specify your wishes.

For a fixed price quote, call our Team of expert or Request a callback and we will call you.

We can help you with the followings:

- Safeguard the future and ensure that the right people benefit

- Help you with Inheritance Tax (IHT) and ensure that your assets are protected for your loved ones.

- Appoint Legal Guardians for children

- We have range of products to suite your requirements whether you are an individual or business owner

Key terms:

- Whatever you have in your estate is the total of everything you own, from your house through to your smallest personal possessions. This is known as an Estate i.e. your net worth.

- By planning an estate plan, you can set out how you want to distribute everything you own to the beneficiary who will inherit from you after you die. This is known as an Estate plan.

you may wish for your estate to be distributed amongst friends; relatives; charitable bodies or Institutions of your choice and in the proportions as specified by you

Do not presume that your other half will get everything. Your siblings or parents may have a claim against your estate. Often, your children will have a right to part of your estate. If you are living as an unmarried couple you could be treated as a single person with your surviving

partner receiving nothing at all. One thing you can be certain of – there will be arguments and disputes at a time when the family should be coping with the loss of a loved one.

You may wish to consider who would look after your child/ children in the event of your death. This is particularly important for single-parents and unmarried fathers without parental responsibility (PR) for births prior to December 2003. A valid Will nominating guardians is invaluable in such cases. If no one knows what you would have wanted, the Court will decide on the future of your children, and it may not be what you would have wished.

May be you made a Will a long time ago. It probably needs updating to include additional grandchildren or deletion of persons whom you no longer wish to leave anything to.

Do I need to plan?

Yes, by sorting out your affairs with an estate plan also means:

• You can let your family and friends know where you keep your will.

• Provide information on everything you own and your total debts (Assets and Liability)

• To keep record of all the gifts that you have given in the last seven years to make sure you do not pay too much tax on your estate.

• making sure your funeral preferences are known by your family.

Frequently asked questions

A will is a legal document that dictates the distribution of assets when you die. If you die without a will, state law governs. You definitely need a will if you are married, have kids, or have a lot of assets. … A will can help your family avoid conflict when you die, and it is not something you should draft yourself.

- Value your estate. Get an idea of what your estate will be worth by drawing up a list of your assets and debts. …

- Decide how you want to divide your estate. …

- You may decide to leave a donation to a charity. …

- Choose your executors. …

- Write your will. …

- Sign your will.

- Money That Should be Used to Pay Outstanding Debts.

- Real Estate, Including Your Primary House.

- Stocks, Bonds, and Mutual Funds.

- Business Ownership and Assets.

- Cash.

- Other Physical Possessions.